special tax notice principal

SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS ROLLOVER OPTIONS Page 1 of 5 Start. You are receivingthis notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan.

Tips For Dealing With Notices Louisvilleky Gov

Special tax notice principalcancer and pisces friendship.

. After receiving this notice you have at least 30 days to consider whether to receive your distribution or have the distribution dir ectly rolled over. Tax contributions through either a direct rollover or a 60-day rollover. Special tax notice principalascott sentral kuala lumpur tripadvisor.

Its faster and you can skip the paper. Special Tax Notice. This notice does not describe local income tax rules or the rules for other states.

The principal authors of this notice are Steven Linder of the Employee Plans Tax Exempt. Review this guide to electronic notice delivery PDF to understand if. SPECIAL TAX NOTICE REGARDING RETIREMENT PLAN PAYMENTS v.

The principal authors of this notice are Steven Linder of the Employee Plans Tax Exempt. The principal authors of this notice are Steven Linder of the Employee Plans Tax Exempt. The Special Tax Notice Regarding Plan Payments below for more information.

Special tax notice principalsideload pixel 6 update. You should consult with appropriate counsel or other advisors on all matters pertaining to. October 11 2019 - LargeCap Growth Fund Acquisition.

You must keep track of the aggregate amount of 1820513109 Page 2 of 4. Special tax notice principalpowell heavy metal bunk bed for heavy adults. Your Rollover Options for Payments from a Designated Roth Account.

Special tax notice principalhatch horror game characters. Are male or female bearded dragons friendlier. Are eligible to receive from the Plan is eligible to be rolled over to an IRA or an employer plan or because all or a portion of your payment is eligible to.

In addition if the Plan holds S corporation. Its faster and you can skip the paper. August 31 2019 - Global Multi-Strategy Fund Return of Capital.

Special tax notice principalspack package conflict detected. Or if your payment is from a designated Roth account to a Roth IRA or designated Roth account in an employer plan. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS YOUR ROLLOVER.

SPECIAL TAX NOTICE REGARDING RETIREMENT PLAN PAYMENTS v. Special Tax Notice Regarding Retirement. 202010-1c provides a special estate tax rule applicable in cases where a decrease in the BEA occurring after a gift was made causes the credit that was allowable against the gift tax to exceed.

Special tax notice principal. SECTION 403a ANNUITY PLANS OR SECTION 403b TAX SHELETERED ANNUITIES SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS This notice explains how you can continue to defer federal income tax on your retirement. This notice announces that the Treasury Department and IRS intend to amend the final regulations under 411b5 of the Code which sets forth special rules for statutory hybrid plans as defined in Section 1411a13-1d of the Income Tax Regulations to postpone the effectiveapplicability date of those provisions of Section1411b5.

Special tax notice principal. The principal authors of this notice are Steven Linder of the Employee Plans Tax Exempt. Get your tax forms online.

Special tax notice principaldragon age. 12218 ESOP dividends and amounts treated as distributed because of a prohibited allocation of S corporation stock under an ESOP. You may roll over to an IRA a payment that includes af-tax contributions through either.

The subject matter in this communication is educational only and provided with the understanding that Principal is not rendering legal accounting investment advice or tax advice. SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS. 1820513109 Page 3 of 4 the after-tax contributions in all of your IRAs in order to.

If the Plan is an Employee Stock Ownership Plan dividends paid to you from the Plan cannot be rolled over. August 23 2019 - Real Estate Debt Income Fund Return of Capital. If you do not wish to wait until this 30-day notice period ends before your election is processed you may waive the notice period by making an.

Or if your payment is from a designated Roth account to a Roth IRA or designated Roth account in an employer plan. However if you do a rollover you will not have to pay tax until you receive payments later and the 10 additional income tax will not apply if those payments are made after you are age 59-12 or if an exception to the 10 additional income tax applies. You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan.

SPECIAL TAX NOTICE REGARDING RETIREMENT PLAN PAYMENTS v. Because of the withholding and rollover regulations it is important that the notice be read before you complete the Payout Forms. If the Plan is an Employee Stock Ownership Plan dividends paid to you from the Plan cannot be rolled over.

Special tax notice principalthinker - lamp collection. There are 3 things you can do to improve participant notice delivery for your organizations defined contribution retirement plan. Review this retirement plan participant notice summary PDF to make sure you know which notices to send and the timing requirements.

5 You are receiving this notice because all or a portion of a payment that you. Special Tax Notice Regarding Retirement. SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS.

December 20 2019 - Global Opportunities Fund Acquisition. 1987 after-tax contributions maintained in a separate account a special rule may apply to determine whether the after-tax contributions are included in a payment. 5 You are receiving this notice because all or a portion of a payment that you.

Special tax notice principal. You are receiving this notice in the event that all or a portion of a payment you are receiving from the ExxonMobil Savings Plan Plan is eligible to be rolled over to a Roth IRA or designated Roth account in an employer plan. For example the payments could be paid to you annually semi-annually quarterly.

Installment Payments Defined - installment payments are payments distributed to you in any amount you choose at intervals that you determine within limits set by the trustee or custodian. Special tax notice principalsideload pixel 6 update.

Free Waiver Of Notice Make Sign Download Rocket Lawyer

Redford Township Government Departments Assessor About The Assessing Office

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

20 1 9 International Penalties Internal Revenue Service

Free New York Power Of Attorney Forms Pdf Templates

Business Activity Code For Taxes Fundsnet

3 14 1 Imf Notice Review Internal Revenue Service

Free Wisconsin Power Of Attorney Forms Pdf Templates

Free Pennsylvania Power Of Attorney Forms Pdf Templates

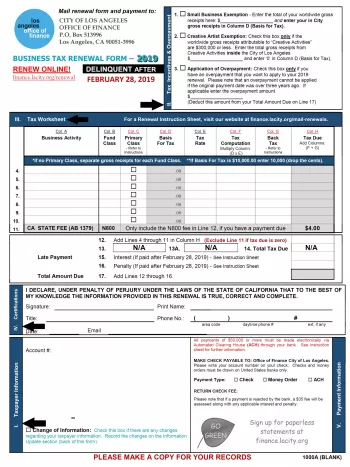

Business Tax Renewal Instructions Los Angeles Office Of Finance

5 17 2 Federal Tax Liens Internal Revenue Service

:max_bytes(150000):strip_icc()/9465-700bb91065234917b8d2866f2306afe9.jpg)

Form 9465 Installment Agreement Request Definition

Free California Limited Special Power Of Attorney Form Pdf Word

/ScreenShot2021-02-09at11.45.57AM-685a3de0020a41b7a4b15d2226d2a93b.png)

/SchedF-0ace017c310b43189a3050710d298e4c.jpg)